Taxes February 3, 2026

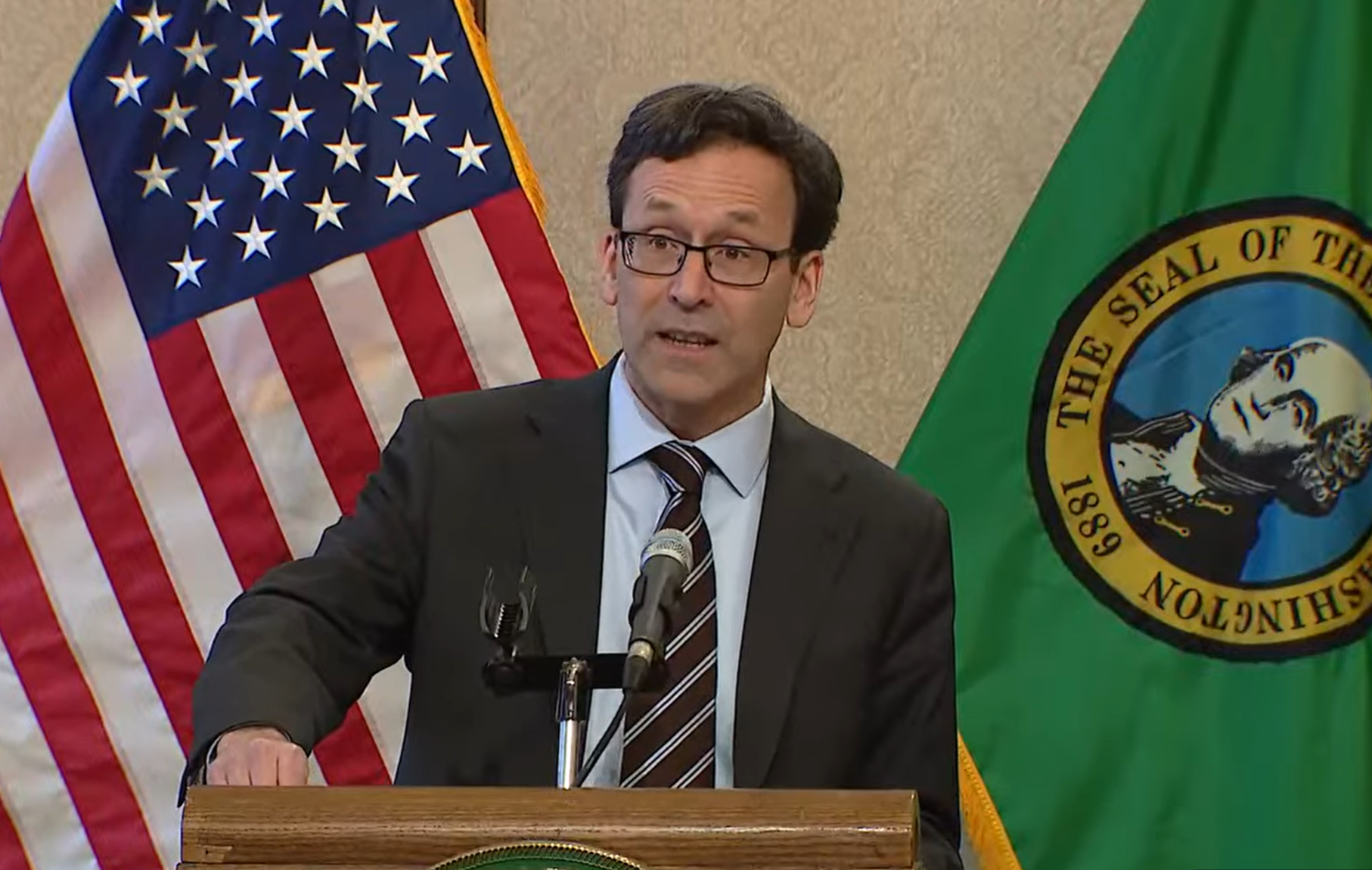

Republicans Look to Rebuke D.C. Council with Swing at Local Tax Code

The House is preparing to vote on a disapproval resolution this week that would reverse a recent measure passed by the D.C. Council that separates some local tax policies from the revamped federal tax code.