Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 5, 2026

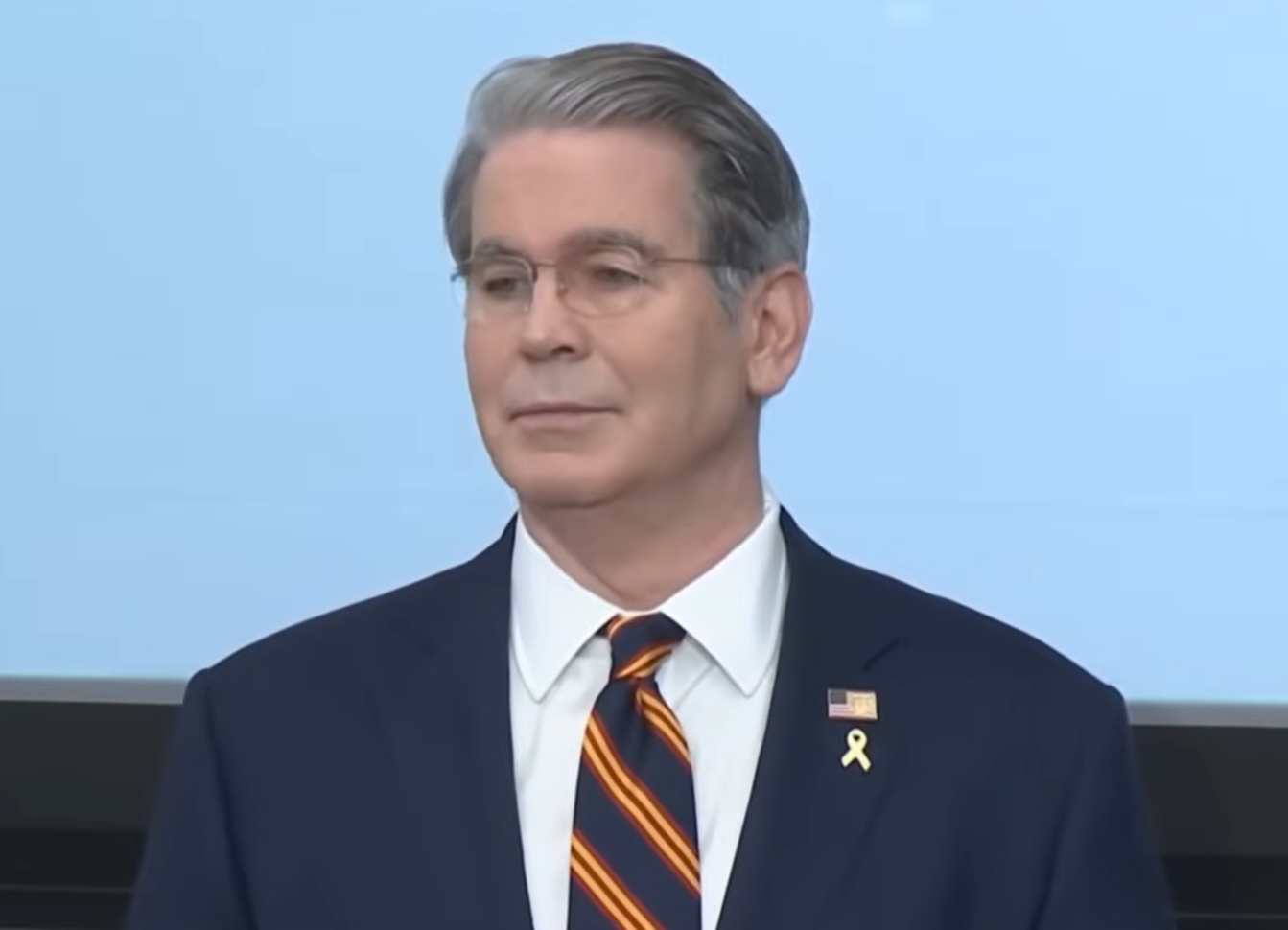

The revelation came Thursday during a Senate Banking Committee hearing where Treasury Secretary and Acting Commissioner of the Internal Revenue Service Scott Bessent testified.

Taxes February 5, 2026

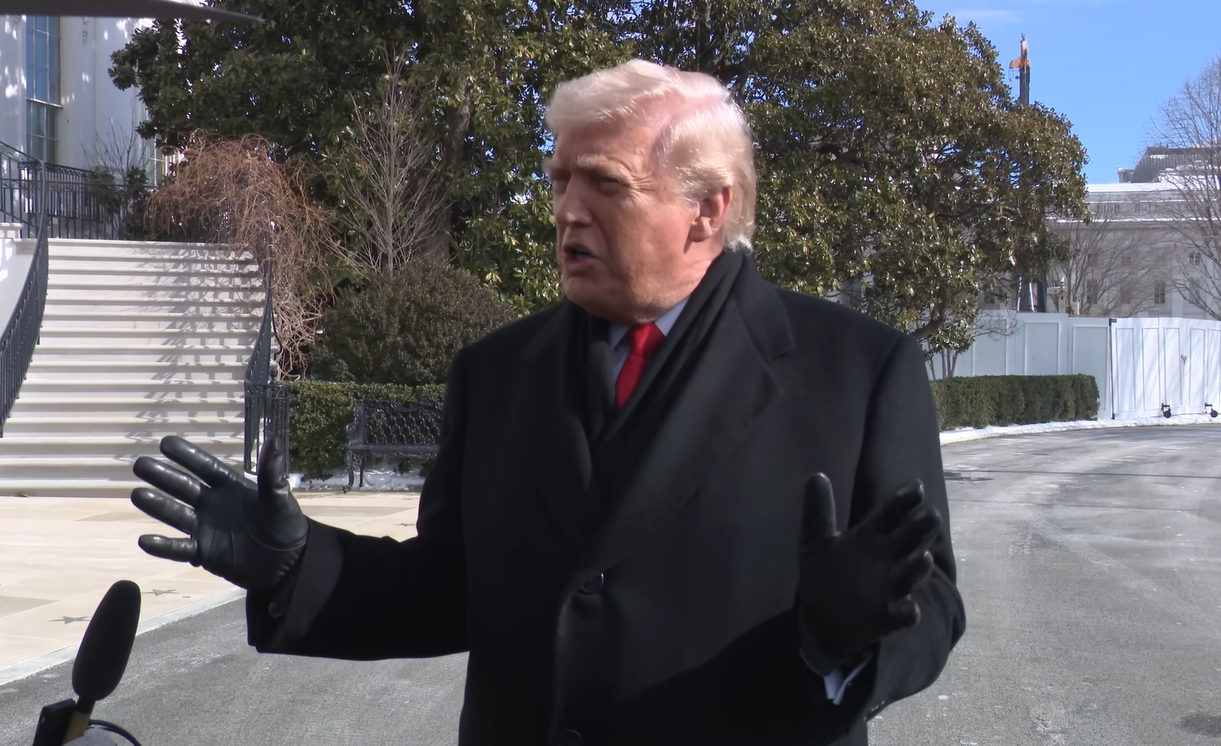

“What I would do? Tell them to pay me, but I’ll give 100% of the money to charity,” President Donald Trump said in an interview with NBC News, floating the American Cancer Society as a potential beneficiary.

Taxes January 30, 2026

The suit was filed Thursday in Miami federal court by the president, his sons Donald Jr. and Eric, and the Trump Organization, which manages the president’s real estate holdings.

Taxes January 15, 2026

The Treasury Department and the IRS released interim rules on the additional first-year depreciation deduction for eligible depreciable property acquired and placed in service after Jan. 19, 2025, provided by the One Big Beautiful Bill Act.

Taxes January 2, 2026

The AICPA said its recommendations to the Treasury Department and the IRS aim to make the rules easier to understand and follow, which would help businesses comply with the law without facing excessive administrative burdens or uncertainty.

Taxes December 31, 2025

The IRS and U.S. Treasury just rolled out official guidance on a brand-new tax deduction that could save car buyers up to $10,000 in 2026.

Taxes December 23, 2025

Announcement 2026-01, which was issued on Dec. 22, notes that future IRS guidance will explain the process of how eligible taxpayers can submit a dyed fuel refund claim.

Taxes December 22, 2025

This new credit, established under the One Big Beautiful Bill Act, is for contributions to scholarship granting organizations that serve elementary and secondary school students from low- and middle-income families.

Taxes December 11, 2025

Scott Bessent targeted New York Gov. Kathy Hochul, Colorado Gov. Jared Polis, and Illinois Gov. JB Pritzker over their state's taxes amid the ongoing holiday season.

Taxes December 11, 2025

The Treasury Department and the IRS provided guidance in Notice 2026-05 on Dec. 9 on new tax benefits for health savings account participants under this summer's One Big Beautiful Bill Act.

Taxes December 8, 2025

The suggestions include recommendations to help alleviate time compression constraints currently impacting the ability of tax practitioners to prepare complete and accurate returns for PTEs, specifically those with tiered structures.