Updated: May 13, 2022: 2:15pm ET:

The American Institute of CPAs (AICPA) released a statement in response to reports of destruction of documents at the Internal Revenue Service (IRS) and their subsequent response. AICPA Vice President of Taxation, Edward Karl, CPA, CGMA commented:

“Considering the struggles the IRS has faced in keeping up with returns’ processing the last two years, the recent TIGTA report highlighting the revelation of the IRS’s destruction of 30 million documents last year has been concerning. IRS management’s decision to destroy information return documents due to the processing backlog raised numerous questions regarding IRS’s decision making and risk assessment process. The IRS’ recent statement provided some of the answers, but American taxpayers deserve to know why this decision was made and how it might impact them. The IRS should continue to operate with transparency on this issue.

“For months, the AICPA has urged the IRS to implement specific recommendations that would help them reduce their backlog more quickly and provide relief to taxpayers, several of which are related to pandemic penalty relief. We are encouraged that the IRS statement indicated that taxpayers and payors have and will not be subject to penalties. However, the AICPA believes that the IRS should be transparent with their remediation strategy to ensure that taxpayers who attempt to be in compliance, and payors who have been compliant with the information reporting requirements do not have penalties imposed on them in the future.”

—–

An audit by the Treasury Inspector General for Tax Administration (TIGTA) has found that the Internal Revenue Service made an intentional decision “to destroy an estimated 30 million paper-filed information return documents in March 2021.” TIGTA says the agency did this because of it’s inability to catch up on backlogs of paper-filed returns.

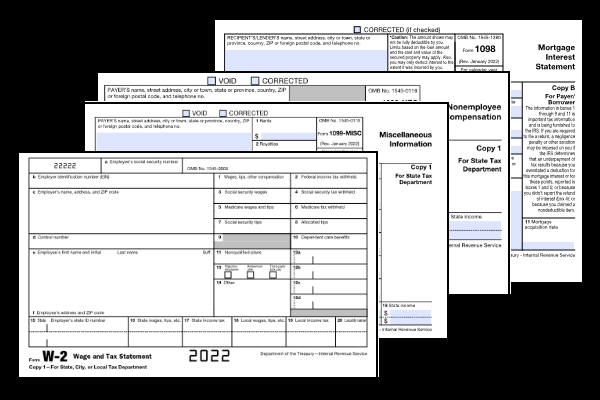

The report does not say that actual 1040 income tax forms from filers were destroyed, but only that information returns used to support tax filings were. “The IRS uses these documents to conduct post-processing compliance matches to identify taxpayers who do not accurately report their income.”

Common information returns include forms W-2, 1099 and 1098, among others.

With the supporting documents destroyed, the IRS will likely be missing many of the documents it requires to adequately screen for accuracy of returns, and may also end up lacking sufficient materials for tax audits. However, the IRS can request taxpayers provide relevant proof or copies of documents used to support their income tax returns, including copies of files the IRS may have destroyed.

TIGTA previously reported that there were actions the IRS could take to reduce paper filings and/or convert paper tax returns into an electronic format. In addition,TIGTA reported that, while the electronic filing (e-filing) of business tax returns continued to increase, the e-filing rate still lags behind that of individual tax returns. Finally, repeated efforts to modernize paper tax return processing have been unsuccessful.

In other findings, TIGTA reported that has taken several steps to increase e-filing, but that the pandemic amplified the backlog of paper tax returns and records. This, TIGTA noted, suggests that the IRS needs to create an agency-wide “strategy to further increase e-filing.”

TIGTA made three overall recommendations as a result of its audit:

- Develop a Service-wide strategy to prioritize and incorporate all forms for e-filing;

- Develop processes and procedures to identify and address potentially non-compliant corporate filers;

- Develop processes and procedures to ensure that penalties are consistently assessed against business filers that are non-compliant with e-filing requirements.

The report from the Treasury Inspector General for Tax Administration is at:https://www.treasury.gov/tigta/auditreports/2022reports/202240036fr.pdf

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs