No one can disagree that preparing taxes requires a lot of documents. In years past, you could always tell when it was tax season by the number of documents on an accountant’s desk. Those documents would need to be organized, scanned, and used in preparing a client’s return. Once the return had been completed, the organized documents then had to be filed away for future access.

The good news is that tax document automation programs can help to reduce many of these time-consuming tasks. They offer time-saving features such as automated scanning, document organization and document management capability. In many cases, these applications can also significantly reduce or even eliminate the amount of data entry necessary by reading and auto-populating information found on scanned documents into the correct form.

Tax document automation was originally designed for larger CPA firms that needed to reduce the amount of time spent managing hundreds of thousands of pages of tax documentation. But even smaller firms can realize significant time savings by using tax document automation applications. This automation also significantly reduces the number of mistakes, document misfiling, lost documents, and transposed numbers that can occur when using manual systems

For instance, tax document organization applications can take a large stack of work papers and organize them into a single digital binder, which includes bookmarks and labels for all relevant documents, while also standardizing the documents in each binder that’s created.

Some of the applications offer the ability to auto-populate tax returns, reducing or eliminating the need for time-consuming data entry. Most of the applications are able to recognize common tax source documents such as W-2s, 1099s, K-1s, and brokerage statements, and are able to review data for accuracy.

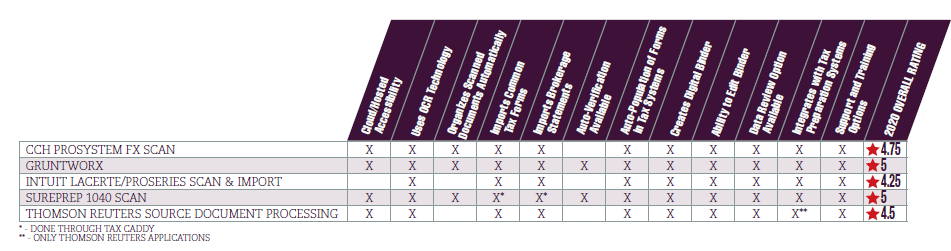

The tax document automation products reviewed in this issue vary, with some better suited to larger firms, while others work better for smaller firms processing fewer returns. Some of the applications are part of a specific tax preparation software, while others are designed as stand-alone applications that can integrate with other tax preparation products.

The products reviewed in this issue include:

- 1040SCAN by SurePrep

- GruntWorx, LLC

- Lacerte and ProSeries Scan and Import

- Thomson Reuters – Source Document Processing

- Wolters Kluwer – CCH, ProSystem fx Scan

(Click to enlarge chart.)

Some of the features we looked at include the ability to populate tax forms, which tax documents were supported, and the ability to create digital files and PDFs of each created folder for future access. We also looked at integration options and whether the application could be used as a stand-alone application or is part of a specific software application.

While it’s a well-known fact that tax document automation will save large firms a lot of time, the fact is that it can save smaller firms a considerable amount of time as well. So, spend a few minutes reading the reviews, download a few demos to try out for yourself, and maybe come tax season, you can leave the office on time.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs