In this issue

December 19, 2013

The Evolving State of Accounting Firm Workflow

Change comes in waves that sometimes are less astounding when looking at them in the present, but can be dramatic when their cumulative effects are viewed after several years.

October 20, 2013

How to Maximize Financial Analysis and Reporting

Businesses often want to see how their company’s financial performance stacks up against the competition, but it’s difficult for accountants to find quality data on comparable, private companies.

October 7, 2013

4 Tips to Improve Firm Workflow Processes

Process improvement has been a stated goal in most firms for some time now. Looking for ways to do more with less became even more important during the economic downturn. And the concepts of Lean Six Sigma that started in manufacturing are now making their way into professional services firms, including accounting.

October 7, 2013

Will New Healthcare Laws Hurt the CPA-Client Relationship?

As this column goes to print, provisions of the Patient Protection and Affordable Care Act (also known as the “ACA,” or ObamaCare) will change accountants and tax preparers from “trusted advisors” to a more derogatory status:

October 2, 2013

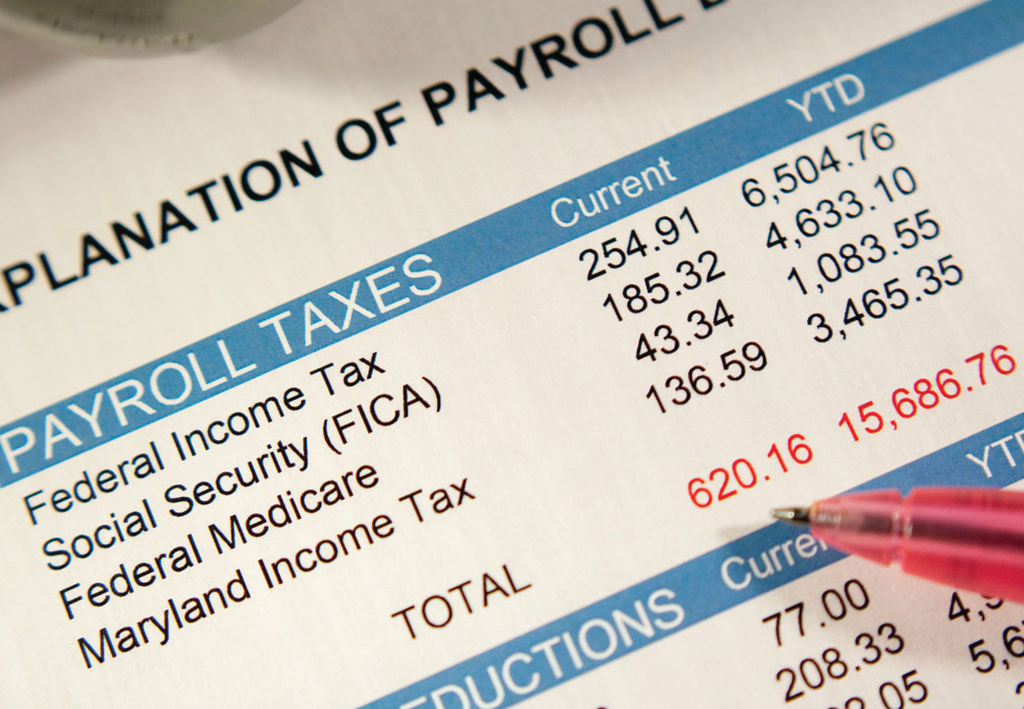

Payroll Systems Becoming More Mobile, with More Employee Self-Service Options

As we began 2013, taxpayers were shrouded in a cloud of uncertainty concerning taxes. That seemed to quickly be resolved for this year and into 2014, but we are now faced with a number of new tax and payroll issues.

October 1, 2013

How Accountants and Tax Pros Can Manage Business Risk

Summer may seem like a time where accountants can take a breath. They’re just past the April tax rush and still a ways ahead of end-of-year planning. But that timing makes August and September the optimum time to work on managing your practice – an essential part of which is managing business risk.

September 30, 2013

Payroll – To Be or Not To Be

Both accounting firms and industry accountants ask me regularly about opportunities for their firms. One area that has been avoided by industry and public practice CPAs alike is payroll. We’d prefer to transfer the work, liability, risk, schedule commitment and governmental reporting to someone else.

September 30, 2013

How to Avoid the Top 4 Household Employment Tax Mistakes

When families become employers, they take on many of the same responsibilities that business employers do – although many of the forms, deadlines and labor laws for household employers are unique.

September 30, 2013

Mastering the Art of Technology

How a tech-savvy firm owner leverages his experience with advanced technologies to create a lucrative new service offering

September 30, 2013

Looking and Feeling Great! The Five Key Components of Your Firm’s Brand Image

Recently I had a fellow CPA visit our firm in Bloomington, Indiana. We spent a few hours talking about processes, growth, the importance of websites, and staffing…all good stuff. Before he left our visitor told me, “Your office has a really comfortable feeling to it, when I walked in it just felt right.” He also…

September 30, 2013

Improving Business with a Virtual Office

When Bryce Forney, CPA realized he was duplicating many tasks and wasting countless hours simply checking email, he knew it was time for a change. He transitioned his email from Outlook to Gmail and began looking for other ways to eliminate waste and redundancy in his practice.