Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Small Business May 3, 2024

There were about 45 sales tax holidays in 24 states in 2023 and could be even more than that in 2024.

![ut_austin_house_for_rent_1_.5713d02d8e979[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2022/07/34677/use_for_rent_1_.5713d02d8e979_1_.5d5453fd9945a.png)

Small Business May 3, 2024

Could tax incentives geared toward turning Hawaii short-term rentals (STRs) into long-term housing increase housing stock and decrease rents for Hawaiians? Governor Josh Green thinks so.

![natural_disasters_list_1_.56117a5e5df03[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2021/12/natural_disasters_list_1_.56117a5e5df03_1_.61c1db14bf0ea.png)

Taxes May 2, 2024

Original documents such as tax returns, Social Security cards, marriage certificates, birth certificates and land ownership documents need to be secured in a waterproof container in a safe space.

Taxes May 1, 2024

The recommendations would simplify filing for taxpayers and practitioners and will reduce the administrative burden on the IRS.

Taxes May 1, 2024

New guidance touches on the role farmers will play in the production of clean jet fuels and reducing emissions in the aviation industry.

Taxes May 1, 2024

The funding helps organizations provide free tax assistance to elderly and low-income taxpayers for up to three years.

Taxes May 1, 2024

Roger Ver was charged with mail fraud, tax evasion, and filing false returns in order to avoid paying at least $48 million in U.S. taxes.

Accounting April 30, 2024

Jeana Ann Lautigar of Edina, MN, was charged with making monetary transactions connected to the crime and failing to file taxes.

Taxes April 30, 2024

Dennis Maxey was arrested in 2019 for grand theft and scheme to defraud, both first-degree felonies. He was arrested again on April 18.

Sales Tax April 30, 2024

Part of the Sovos Compliance Cloud, the Indirect Tax Suite empowers enterprises to manage all of their indirect tax obligations with governments, buyers, suppliers and consumers.

Taxes April 29, 2024

Beginning May 28, the IRS will accept applications from taxpayers seeking tax credits from the pool of $6 billion allocated in Round 2.

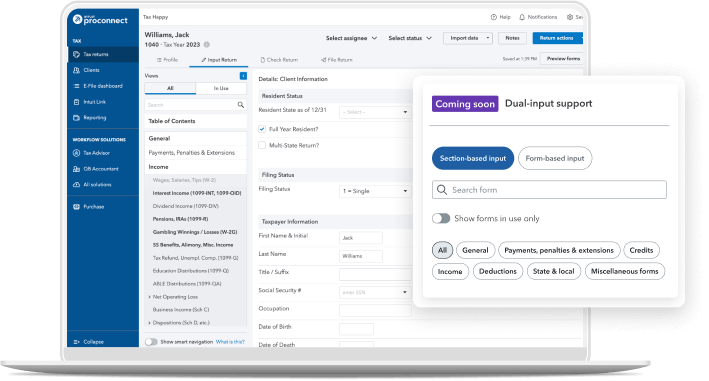

Advisory April 29, 2024 Sponsored

During the Intuit Accountants “Better Together” event in New York City, the Intuit ProTax Group brought together tax professionals and industry thought leaders.