Taxes December 4, 2025

Democrats Tee Off on Possible Treasury Corporate Tax Move

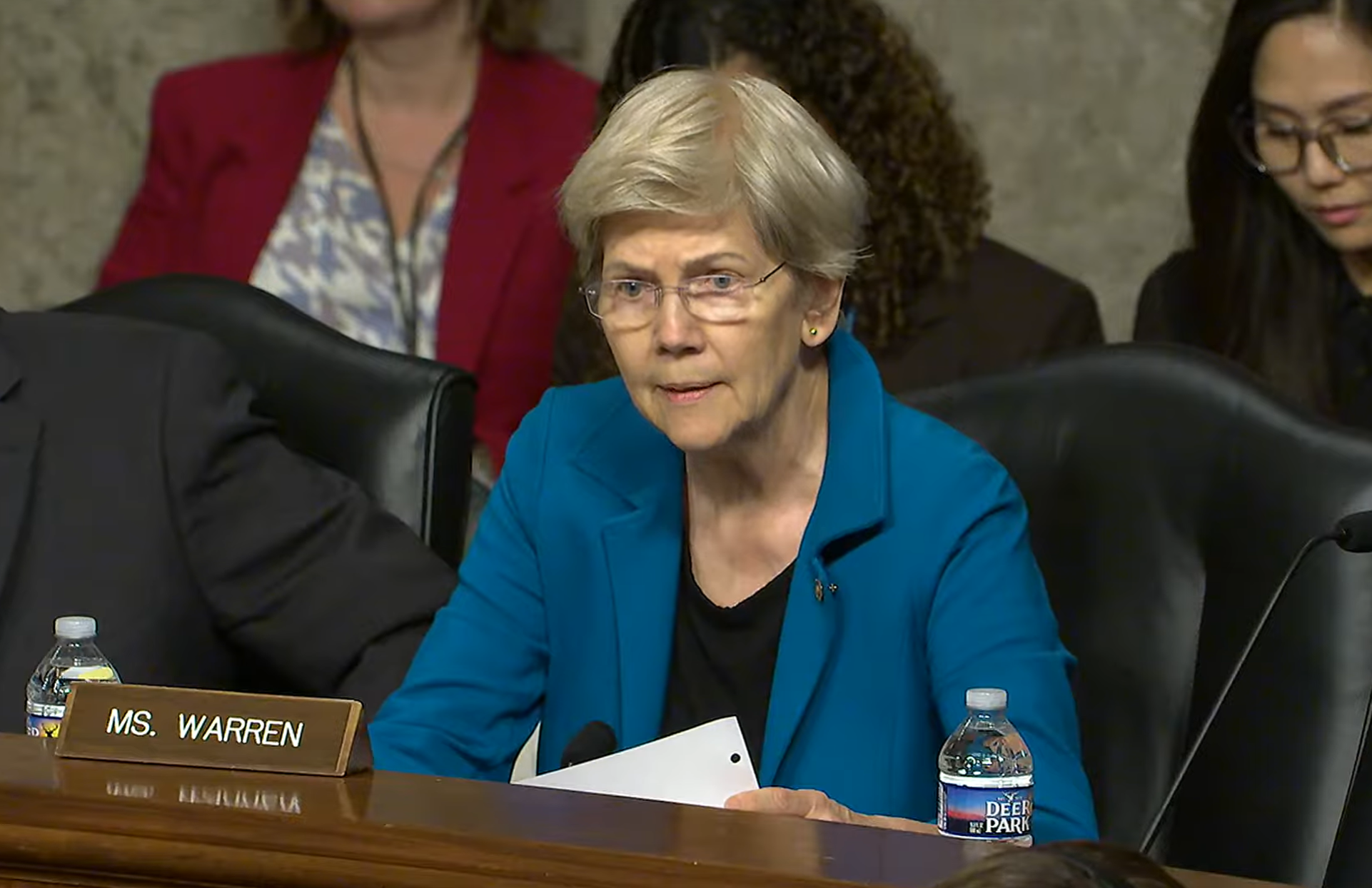

Sen. Elizabeth Warren and Rep. Donald S. Beyer Jr. are leading opposition to a potential regulatory carve-out from a new minimum tax on corporate profits that critics say could generate an unjustified windfall for big companies.